| The e-Invoicing system is a significant step forward for the Malaysian government’s digitalization agenda. It is expected to have a positive impact on the economy and help to improve the efficiency of the tax system. The e-Invoicing system is designed to improve the efficiency and transparency of the invoicing process. It will also help to reduce tax evasion and fraud.

|

|

|

What Is E-Invoicing?

|

| E-Invoicing is not a human-readable PDF invoice. It is a machine-readable format. Malaysia LHDN e-Invoicing only accepts machine-readable XML, JSON files, not PDF, DOC, JPEG, or email.

|

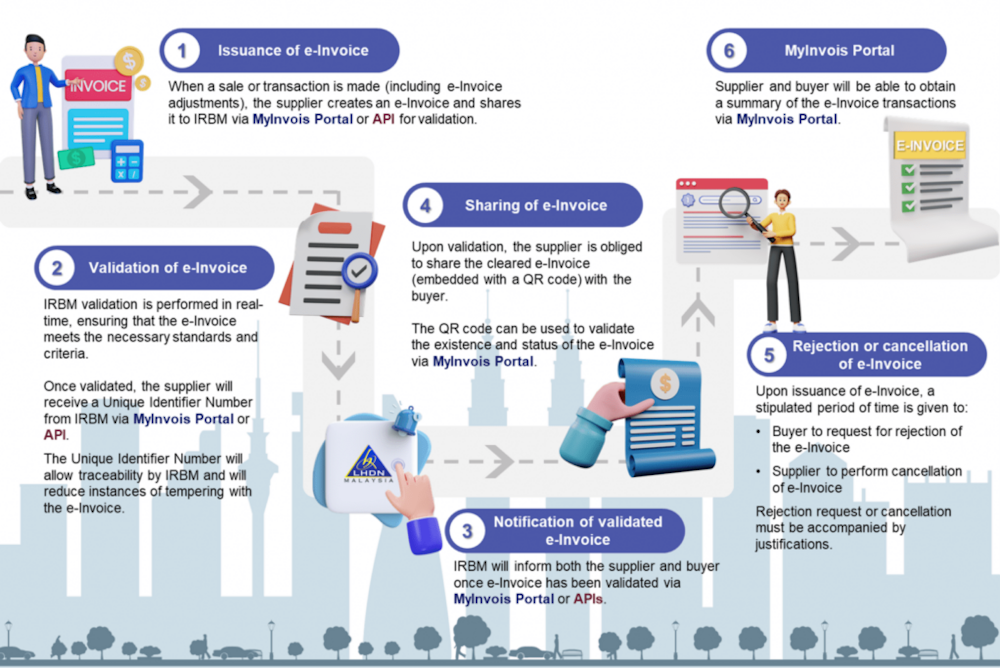

| Every invoice must be sent to LHDN for approval and validation by the Inland Revenue Board (IRB) before it can be printed as a verified invoice for your customer. IRBM will validation includes TIN and e-Invoice data structures / format. Upon validation of the e-Invoice, the supplier is obliged to share the cleared e-Invoice with the buyer after embedding the validated link (provided by IRBM) in a form of QR code on the e-Invoice. The QR code can be used to validate the existence and status of the e-Invoice via MyInvois Portal.

|

|

|

How Long Does E-Invoicing Validation Take?

|

| Refer to the IRBM e-Invoice guideline version 1.0, IRBM will develop the Continuous Transaction Control (CTC) Model where the validation is done instantly (or near-instantly) by IRBM.

|

|

|

|

|

Who Are Required To Implement E-Invoicing?

|

| Any business voluntarily to adopt e-Invoicing with LHDN Malaysia will be effective from 1 January 2024. The mandatory implementation will be based on turnover or revenue thresholds and will be implemented in phases starting from 1 June 2024. However, taxpayers are welcome to implement e-Invoice at an earlier phase voluntarily. The implementation details are as follows:

|

|

|

| Phase

|

Start Date

|

Annual Turnover / Revenue

|

| 1

|

1 June 2024

|

> RM100 million

|

| 2

|

1 January 2025

|

> RM50 million

|

| 3

|

1 January 2026

|

> RM25 million

|

| 4

|

1 January 2027

|

All tax payers and some non-business transactions

|

|

|

|

|

|

What Information Will Be Store In IRBM Database?

|

| Every invoice issued must include the following information, which will be stored in the IRBM Database. This information is required to ensure the authenticity, integrity, and traceability of e-Invoices. It possible also used by the tax authorities to verify the accuracy of tax returns.

|

|

|

- General Information:

This includes the invoice number, e-Invoicing type, e-Invoicing purpose, e-Invoicing date (current date)

- Supplier & Customer Information:

This includes the supplier and customer’s TIN, name, address, email address, 5 digit MSIC code, MSIC description, website, contact person, and contact number, company registration number/individual myKad number/passport, SST registration number, currency, exchange rate

- Item Information:

This includes the description, quantity, uom, unit price, discount rate, discount amount, tax type, tax code, tax rate, and tax amount, tariff code, subtotal, total excluding tax, total including tax for each item on the invoice

- Validation Information:

This includes the IRBM Unique Identifier Number, validation date and time, and validation status of the invoice

- Digital Certificates / Signature:

Digital Certificates will be issued to taxpayers to enable them to attach digital signatures to e-Invoices. The digital signature will verify that the submitted e-Invoice data originates from a specific taxpayer

- Additional Information (Optional):

This may include payment mode, supplier bank account, payment terms, payment amount, payment date, payment reference number, bill reference number, and other relevant information

|

|

|

What Is TIN Number?

|

| A TIN number in Malaysia is a Tax Identification Number, also known as Nombor Pengenalan Cukai. It is a unique number assigned to individuals and entities registered as taxpayers with the Inland Revenue Board of Malaysia (IRBM). The TIN number is used by the IRBM to identify taxpayers and track their tax records. It is also utilized by the IRBM to monitor taxpayer compliance and detect tax evasion.

|

|

|

| The Inland Revenue Board of Malaysia (LHDN) has announced an update to the format of Tax Identification Numbers (TINs) for Malaysian taxpayers. The new format will be effective from January 1, 2023.

|

|

|

| The old TIN format was a 12 or 13-digit number, with the first one or two letters indicating the type of taxpayer, such as “SG” for individual residents or “C” for companies. The remaining digits constituted a unique identifier for the taxpayer.

|

|

|

| The new TIN format will consist of a 13-digit number. The first two letters will be “IG,” which stands for “Individual taxpayer.” The remaining 11 digits will remain the same as the old TIN number. Here’s how to check your TIN number online.

|

|

|

| For more information about the new TIN format, please visit the LHDN website.

|

|

|